How Forex PAMM accounts work?

If you keep a knack of interest in trading globally with foreign currencies then forex is definitely for you. In forex currency exchange markets, traders have to be skillfully the best to turn the bullish markets in their favor. Sometimes it happens so that you as a trader have all the capabilities, funds and good brokers, that counts money and resources to help you start trading but due to lack of time you are unable to do so. Therefore, if you don’t have sufficient time to invest in forex trading then, Forex PAMM accounts will be a good choice for you.

Firstly, what is a PAMM account?

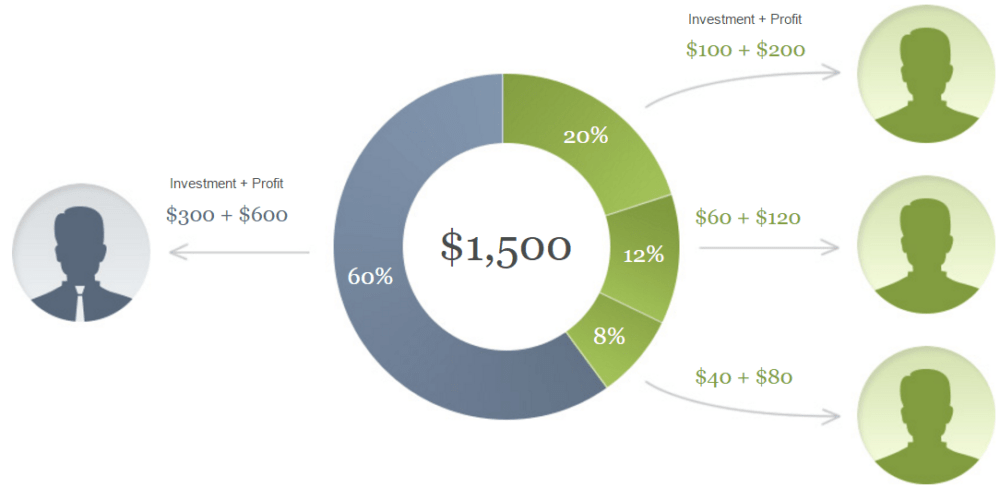

In forex trading, percentage allocation management module, which is also known as percentage allocation money management or PAMM, is a type of pooled money forex trading in which an investor gets an opportunity to allocate his or her money in his or her will of proportion to the qualified trader(s)/money manager(s) of his or her choice. Then these traders/managers may manage multiple forex trading accounts using their own capital and such pooled moneys, with an aim to generate profits.

How does it work?

For example, say, below mentioned are the participants while setting up a percentage allocation money management (PAMM) account:

- forex broker/ forex brokerage firm

- trader(s)/ money manager(s)

- investor(s)

Now, say the investors, be it whosoever, are interested in reaping their desired profits from forex trading, but due to lack of time that they are unable to give and to devote to trading activities or don’t have sufficient knowledge to trade forex, they enter the professional money managers, be it whosoever, who have expertise in trading and managing other people’s money, say one like a mutual fund manager, along with their individual trading capital. The forex trading firm signs up these professionals as money managers for managing another investors’ money. Now, the investors also signup with Limited Power of Attorney (LAOP). The crux of the signed agreement is that investors agree to take the risk for the forex trades, by giving their capital to their own chosen money manager who will use the pooled money to trade forex per his trading style and strategy. It also states how much the money; the manager will charge as his take for offering this particular service to the investor.

PAMM accounts are very simple as well as hassle-free method for individuals and early traders to pick and choose their money managers for forex trading. With the help of PAMM accounts, investors benefit from profits with minimal involvement. However, PAMM accounts also carry the risks of capital loss, based on a money manager’s performance. After understanding their desired profit potential and risk aversion, individuals should perform due diligence in selecting a PAMM accounts broker and money manager.